How does Sales Enablement help the Financial Service Industry?

The financial services industry operates in a highly regulated, competitive environment, where sales and marketing teams struggle not just with compliance but also with leveraging data effectively to drive decision-making.

Consider a financial advisor pitching a new wealth management product to a high-net-worth client. They navigate a multi-step process involving legal reviews, compliance checks, and approvals from multiple stakeholders.

Despite weeks of preparation, a misstep in regulatory compliance or the inability to harness client insights effectively leads to delays, eroding trust and derailing the deal.

This challenge is widespread—86% of financial services business leaders lack confidence in using their data to drive decision-making (InterSystems, 2023).

Summary

The financial services industry faces ongoing challenges with client confidentiality, long sales cycles, and strict compliance requirements. Sales teams must navigate complex decision-making while ensuring trust and regulatory adherence.

Sales enablement helps by centralizing content, secure data sharing, and streamlining workflows, improving collaboration and efficiency. With the right strategies, financial institutions can maintain compliance and accelerate deal closures.

This blog explores the role of sales enablement, its impact on sales performance, and key strategies for success in a competitive market.

Sales Enablement for Financial Services

Sales enablement helps financial sales teams stay compliant, engage high-value clients, and maintain consistent messaging while streamlining operations.

1. Secure, Compliant Tools for Managing Sensitive Data

Automated compliance checks and secure document sharing ensure data security and adherence to FINRA, SEC, and GDPR regulations, reducing legal risks.

2. Personalized Engagement with High-Value Clients

AI-driven insights help sales reps anticipate client needs and deliver tailored financial solutions, strengthening relationships and accelerating deal closures.

3. Centralized Content for Consistent Messaging

A single content hub ensures all teams use approved, up-to-date materials, preventing misinformation and maintaining compliance and credibility.

4. Faster Onboarding and Continuous Training

Sales enablement platforms provide interactive training and real-time coaching, helping new and existing reps stay updated on compliance changes, product offerings, and best practices.

5. Data-Driven Decision Making

With sales analytics, teams gain insights into buyer behavior, content engagement, and deal progress, allowing them to refine strategies and focus on high-value opportunities.

Sales teams in financial services face a unique set of challenges that stem from strict regulations, long sales cycles, and evolving client expectations. Addressing these issues effectively requires a combination of structured processes, compliance-driven strategies, and data-driven insights.

Why is Sales Enablement Important for Financial Services?

1. Client Confidentiality

- Challenge: Handling and sharing sensitive client data securely without breaching confidentiality agreements or compliance laws.

- Solution: Implement encrypted storage, secure document-sharing protocols, and access-controlled communication to protect client information while ensuring seamless collaboration.

2. Regulatory Compliance

- Challenge: Navigating complex and ever-changing financial regulations across multiple regions while ensuring that all sales communications remain compliant.

- Solution: Maintain a centralized repository of compliance-approved content, conduct regular regulatory audits, and train sales teams on evolving legal requirements.

3. Long Sales Cycles

- Challenge: Financial products often require multiple approvals and extensive due diligence, leading to prolonged decision-making processes.

- Solution: Clearly defining approval workflows, engaging decision-makers early, and leveraging data-driven client insights can help accelerate sales timelines.

4. Inconsistent Messaging Across Teams

- Challenge: Sales teams often use outdated or non-compliant materials, leading to inconsistencies in client communication.

- Solution: Standardize messaging through compliance-reviewed content libraries and ensure all client-facing teams have access to up-to-date materials.

5. Difficulty in Personalizing Client Engagement

- Challenge: High-value clients expect personalized financial solutions, but strict compliance measures often limit customization in outreach.

- Solution: Use structured client profiling and data analysis to tailor interactions while staying within regulatory guidelines.

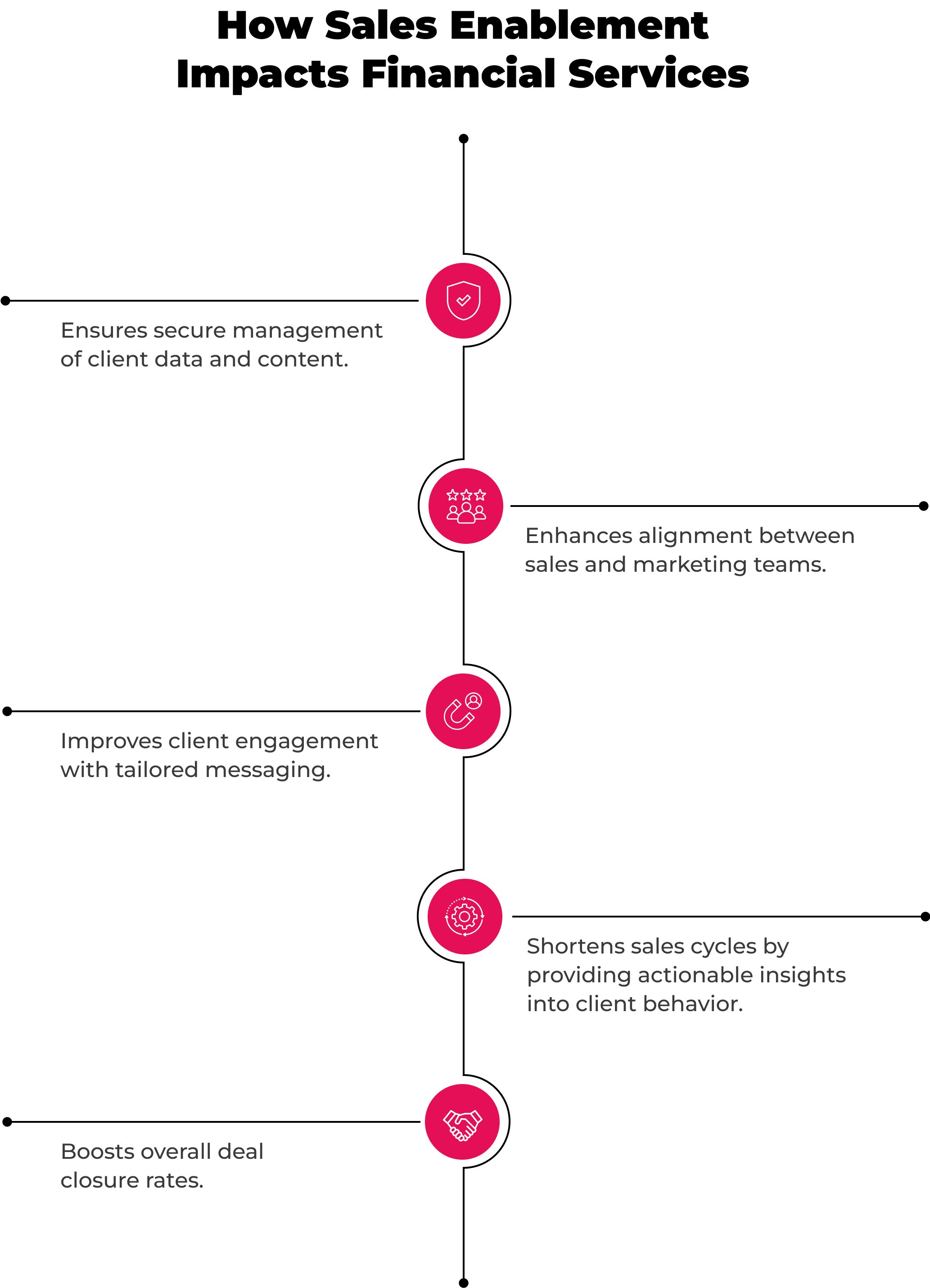

Key Impacts of Sales Enablement on Financial Services

Sales enablement directly impacts several key performance indicators (KPIs) for financial services sales reps, helping them improve efficiency, compliance, and deal closures. Here are the most important ones:

1. Sales Cycle Length

- Why it matters: Financial products involve multiple stakeholders and compliance reviews, often leading to long sales cycles.

- Impact of Sales Enablement: Streamlined workflows, centralized content, and better stakeholder engagement help shorten sales cycles.

2. Conversion Rate

- Why it matters: A high conversion rate indicates that reps are effectively engaging and persuading clients.

- Impact of Sales Enablement: Access to personalized, compliance-approved content improves client trust and increases deal closure rates.

3. Deal Size / Revenue per Rep

- Why it matters: Higher-value deals contribute to greater profitability.

- Impact of Sales Enablement: Data-driven insights help reps identify upsell and cross-sell opportunities, increasing average deal size.

4. Client Engagement Metrics

- Why it matters: Strong engagement leads to better client relationships and higher retention.

- Impact of Sales Enablement: Personalized outreach and relevant content increase meeting attendance, response rates, and overall engagement.

5. Compliance Adherence Rate

- Why it matters: Regulatory non-compliance can lead to legal risks and lost deals.

- Impact of Sales Enablement: Ensures all communications and materials align with FINRA, SEC, and GDPR guidelines.

6. Time Spent on Non-Selling Activities

- Why it matters: Reps often spend too much time on admin tasks instead of client interactions.

- Impact of Sales Enablement: Automating documentation, content retrieval, and approval workflows reduces time wasted on non-sales activities.

Implementing Sales Enablement in Financial Services

Hiring and Onboarding:

- Train sales representatives on best practices for handling sensitive client data, ensuring compliance with regulatory requirements.

- Conduct regular training sessions to keep teams updated on changes in financial regulations and sales enablement technologies.

- Provide access to a centralized repository of pre-approved, compliance-checked content to ensure consistency in client communications.

Prospecting:

- Use AI-powered tools to identify and qualify high-value prospects while ensuring secure data management practices.

- Leverage CRM integrations to streamline lead tracking, ensuring all interactions comply with regulatory standards.

- Equip sales teams with data-driven insights to enhance targeting strategies and improve engagement efficiency.

Engagement:

- Implement personalized digital sales rooms where clients can securely access relevant materials tailored to their needs.

- Enable secure, interactive content sharing through sales enablement platforms to foster trust and streamline communication.

- Utilize analytics to monitor client interactions and refine engagement strategies based on behavioral insights.

Closing Deals:

- Track client interactions using AI-driven insights to identify optimal moments for follow-ups and closing negotiations.

- Provide financial advisors with compliance-approved materials to ensure all information shared aligns with industry regulations.

- Streamline approval processes by integrating automated workflows that reduce delays and enhance efficiency in finalizing transactions.

Sales Enablement Tools for Financial Services

1. Paperflite:

Overview:

Paperflite is a content management and sales enablement platform that ensures sales reps have quick access to the right materials at the right time. It helps streamline content workflows, enabling sales teams to share relevant resources with prospects effortlessly.

Paperflite, helps to identify the content that performance well with the prospects with its analytics, this further helps the sales reps in sharing content that has higher possibilities of conversion, they will no longer have to shoot the darts in the dark and this makes their follow ups and emails more effective.

Key Features of Paperflite

- Streamlined Content Management

Paperflite centralizes all sales collaterals, allowing reps to access the right content effortlessly. This minimizes time spent searching for materials, enabling quicker and more precise responses to client needs. - Insight-Driven Engagement

With Paperflite’s analytics, sales reps can track how clients interact with shared content. Metrics like views, time spent, and downloads provide clear insights into what resonates with the buyer. This data empowers reps to refine their approach, ensuring that they share content that aligns perfectly with client requirements. - Buyer Persona and Behavior Insights

Paperflite delivers reliable insights into buyer personas and behaviors, allowing sales reps to anticipate client needs without requiring direct feedback. This proactive approach enhances customer satisfaction and engagement. - Real-Time Engagement

The Engage feature equips sales teams to analyze and optimize interactions with clients throughout their buyer's journey. Key functionalities include:- Collaborative Conversations: Foster better communication within teams and with clients.

- Real-Time Notifications: Stay informed about client actions to initiate timely conversations.

- Data and Insights: Leverage actionable data to make informed decisions.

- Engagement Score: Gauge client interest and prioritize follow-ups effectively.

- Seamless Integrations

Paperflite integrates with world-class software tools, ensuring a smooth workflow across CRM, email, and other sales platforms. This integration eliminates redundancies, saving resources and time. - Data Security

- Hippa compliance

- SOC2 certified tech

- Compliant & accurate content

- iPad adaptive & Field sales enablement

Pros:

- Reduces the time spent searching for content.

- Provides insights into what content resonates with prospects.

- Enhances collaboration between sales and marketing teams.

OpenAI Capabilities:

Paperflite can integrate with AI-driven analytics to recommend the best content for specific scenarios, boosting engagement and conversion rates.

2. Pitcher

Overview: Pitcher is a comprehensive sales enablement platform designed to enhance customer engagement for sales, marketing, and field teams. It offers tools to manage content, deliver interactive presentations, and gain customer insights.

Key Features:

- Content Management: Centralized repository for sales and marketing materials.

- Interactive Presentations: Tools to create engaging client presentations.

- Analytics and Reporting: Insights into content performance and client engagement.

- CRM Integration: Seamless integration with existing CRM systems.

- Offline Access: Ability to access content without an internet connection.

AI Capabilities: Pitcher offers AI-driven analytics to provide insights into client engagement and sales performance.

Pros:

- User-friendly interface with adaptable design.

- Superior customer service.

- Comprehensive features including order capturing, task management, and customer dashboards.

3. Showpad

Overview: Showpad is a sales enablement platform that combines content management with training and coaching to enhance sales interactions. It provides a centralized hub for sales content and integrates with various CRM systems.

Key Features:

- Content Management: Centralized storage and organization of sales materials.

- Sales Training and Coaching: Tools to train sales teams and provide ongoing coaching.

- Analytics: Insights into content usage and sales performance.

- CRM Integration: Seamless integration with CRM platforms.

- Shared Spaces: Collaborative areas for sales reps and clients.

AI Capabilities: Utilizes AI to provide content recommendations and enhance sales interactions.

Pros:

- Intuitive and clean user interface, making it easy to navigate.

- Facilitates quick access to relevant sales materials during client presentations.

- Strong customer support and continuous updates.

4. Outreach

Overview: Outreach is a sales engagement platform that automates and streamlines sales workflows. It offers tools for email sequencing, call tracking, and performance analytics to enhance sales productivity.

Key Features:

- Email Sequencing: Automated email campaigns with personalized touches.

- Call Tracking: Monitor and record sales calls for quality assurance.

- Performance Analytics: Insights into sales activities and outcomes.

- CRM Integration: Syncs with major CRM systems for seamless data flow.

- Sales Playbooks: Guided selling strategies to improve effectiveness.

AI Capabilities: Offers AI-powered selling features that automate and intelligently guide sales processes for maximum efficiency.

Pros:

- Enhances engagement and helps close deals more effectively.

- Provides strategic planning tools for revenue maximization.

- Integrates coaching and performance management into daily workflows.

5. Quark

Overview: Quark provides sales enablement solutions tailored for financial services firms, emphasizing the creation and management of compliant, on-brand content.

Key Features:

- Content Automation: Rapid creation of personalized sales materials while ensuring brand consistency and compliance.

- Digital Publishing: Distribution of interactive content across multiple channels.

- Analytics: Insights into content performance to understand client engagement.

- Collaboration Tools: Facilitates teamwork between sales and marketing departments.

- Template Management: Ensures all materials adhere to brand guidelines.

AI Capabilities: Provides AI-driven content automation and digital publishing solutions.

Pros:

- Rapid creation of personalized sales materials while ensuring brand consistency and compliance.

- Enables distribution of interactive content across multiple channels.

- Offers insights into content performance to understand client engagement.

Parting with:

Financial services sales enablement plays a critical role in overcoming industry-specific challenges such as stringent compliance requirements, maintaining confidentiality, and managing long sales cycles. These challenges demand a strategic approach to content distribution, customer engagement, and sales efficiency.

By leveraging tools like Paperflite, sales and marketing teams can streamline their workflows with secure, compliant, and efficient content management solutions. These platforms enable seamless collaboration, ensure regulatory adherence, and enhance buyer engagement, ultimately leading to improved sales outcomes.

As financial institutions continue to navigate evolving market demands and regulatory landscapes, adopting robust sales enablement strategies will be key to maintaining a competitive edge. Investing in the right technology empowers teams to deliver the right content at the right time—driving trust, efficiency, and business growth.